Being able to do administration was probably not the reason why you started a restaurant. In addition to all the invoices and flying receipts, you also have to deal with a lot of staff changes. A lot of administration that nonetheless requires the right attention.

Planning, margins, cost price calculations and then also the payroll administration. All things you’d prefer to spend as little attention on as possible. IBEO transforms this annoying administration into data that you can immediately use. Is it peak season and do you have a lot of changing staff? Then you have this arranged with our simple contract module. With this you generate and extend contracts with just one push of a button. And thanks to digital signing, you no longer have to think about all those papers. Because we connect not only cash register but also planning systems, all staff and hour changes are directly entered into the payroll administration. Never again hassle with keeping lists and schedules.

Besides personnel administration, there are still enough challenges for your purchase and sales administration. Here we are happy to help you with clear reports and cost price calculations so you know exactly what your final margin is. Because how much does exactly one gram of steak with 4 percent cutting loss cost? Thanks to our connections we make this directly visible. And the chef who had to do some last-minute extra shopping? He takes a photo of the receipt and uploads it himself into the bookkeeping. No hassle with manual actions or shared logins. Everyone gets the right permissions to perform their work as easily and quickly as possible.

THE hospitality accountant of the Netherlands

From booking receipts to arranging your tax return, IBEO is the hospitality accountant your hospitality business can rely on.

- Your complete bookkeeping outsourced for a fixed amount per month

- Our enthusiastic hospitality experts are ready for you every day

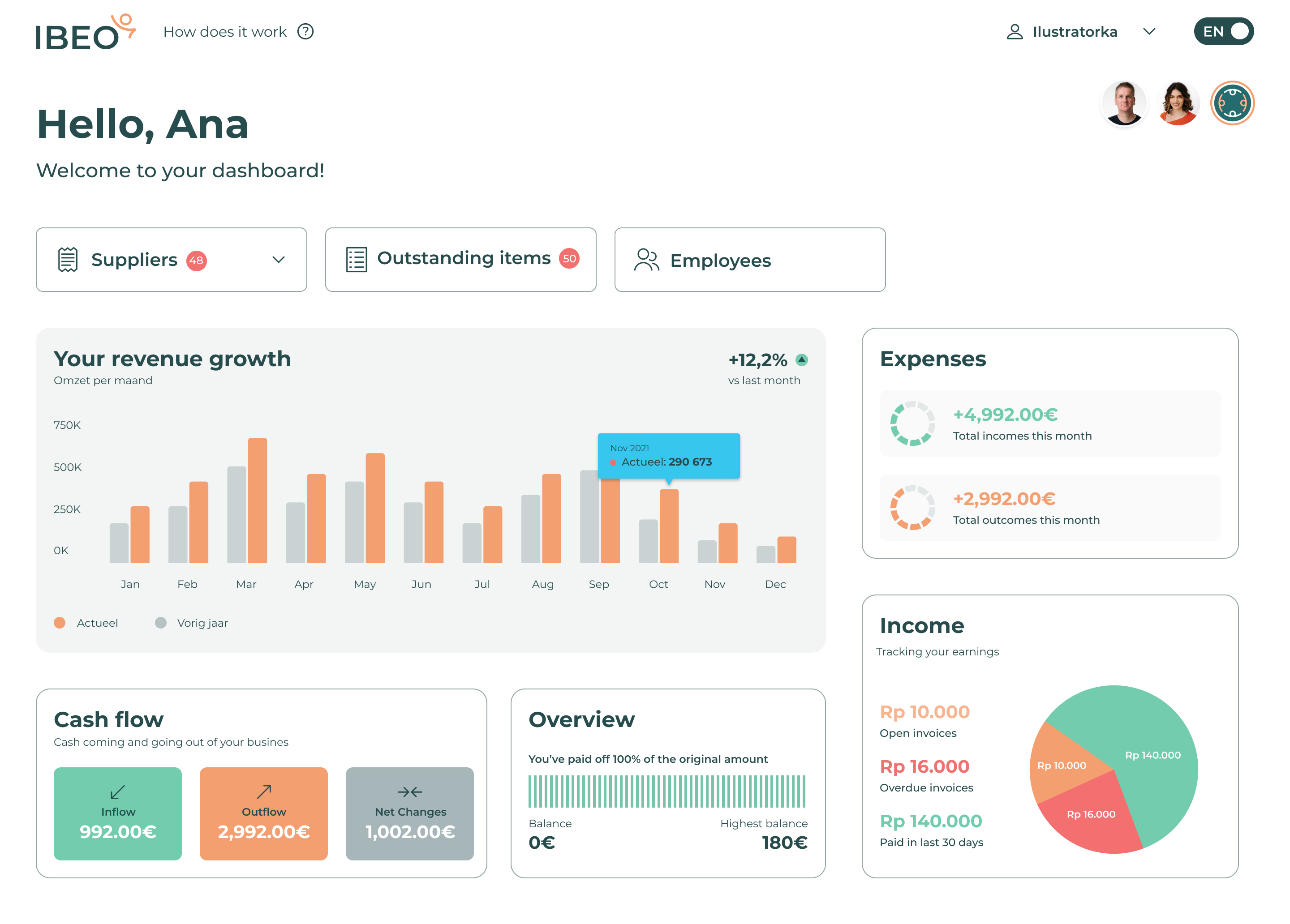

- 24/7 digital insight into your financial situation via your personal IBEO Dashboard

- With smart software we translate your administration directly into usable data

Introduction

Knowledge supported by technology

With our hospitality accountant background, we have been the largest accountant of accountants in the Netherlands for over 10 years. Our team of hospitality experts annually takes care of the complete hospitality administration for more than 1000 hospitality clients. Thanks to smart software, you only need to deliver the financial administration digitally via your personal online dashboard. We do the rest.

More time for your business

Together with our professionals we have one ultimate goal: Automating your complete administration. Save time by using the best tools and say goodbye to frustration. Working with IBEO quickly halves the time you normally spend on doing your administration.

Why do you choose as a hospitality entrepreneur for IBEO?

Your own expert for all your questions

Quick answer to your question. At IBEO you get your own specialist who is always there for you. Our specialists, in addition to financial, legal and tax knowledge, all have a background in hospitality. This way we not only advise you based on figures, but we understand like no other what operational challenges you deal with daily.

Always green numbers

Do you also find it difficult to determine if you’re using the right margins? Margins can make you, or break you. We convert your administration into understandable data. This way you immediately see if your margins are still correct or if you need to adjust. Need advice? Your personal IBEO expert is happy to help you. This way you always stay ahead and never lag behind the facts.

Seamless integrations

Do you have a lot of data, but not clear reports? Then we’d be happy to show you how it can be different. We help you choose the right tools and ensure that all data comes into our system. This way the bookkeeping of your business is always up-to-date. Work smarter, not harder.

Personnel administration without worries

Always a good overview of your personnel costs and productivity. Without hassle you set up contracts, have them digitally signed, employees request leave and you register absence. Is a contract expiring or is someone having a birthday? Then you automatically receive a signal. And the salary processing? No worries, we do that for you. Focus on your staff, not on the administration.

This is what clients say about

IBEO

This is how we keep a grip on the figures together

The IBEO menu

You deliver

Via your personal IBEO dashboard or handy app you digitally deliver the administration when it suits you. Upload receipts, scan purchase invoices or see which bills are still outstanding. Haven’t logged in for a while? You always receive a signal when an invoice still needs to be paid. We connect with as much other hospitality software as possible. This way everything can be processed directly digitally.

We process

Every week, month or quarter we process your entire administration. From booking invoices to preparing the annual accounts. In addition, we schedule a personal conversation every time in which we show you how we can support your hospitality business even more. And do we need something in the meantime? Then we just make personal contact with you.

You have insight

Via the IBEO dashboard you always have online access to clear reports. Steer on current margins, view your online cash book or see which bills still need to be paid. At a glance you know how things stand.

We connect with the best software including

Rates

A suitable solution for every business

Never look back at your hospitality administration again? We ensure that your hospitality bookkeeping is well arranged for a fixed monthly price. You choose processing per month, week or quarter.

And if you need more or less insight, you can easily adjust your package in the meantime without a notice period.

Weekly

Up-to-date every quarter.

- Weekly processing of administration

- Sepa payment batches

- Weekly update about your admin

- Reports

- Monthly closing and personal contact

€449 /from per month

Contact us for more detailsMonthly

Everything in order every month.

- Weekly processing of administration

- VAT return

- Preparation of reports

- Handy administration tools

- Personal contact

€499 /from per month

Contact us for more detailsFull-service

Everything is meticulously taken care of every week.

- We provide complete peace of mind

- We perform the complete bookkeeping and contact suppliers and manage your finance inbox

€599 /from per month

Contact us for more detailsCurious about the most frequently asked questions about our rates?Click here

Our Hospitality specialists

The most important matters in order

From the hospitality industry, for the hospitality industry. Thanks to our love for accountants and background in your industry, we are the hospitality accountant of the Netherlands.

- Your complete bookkeeping outsourced for a fixed amount per month.

- A personal hospitality expert who is ready for you every day.

- Always digital insight into your financial situation via your personal IBEO Dashboard.

- Service throughout the Netherlands.

Frequently asked questions

I have charged an advance payment, do I have to pay VAT on this?

When you ask for an advance payment and it is immediately clear which service you are going to provide for this, you must indeed charge VAT.

Example: You ask for a down payment of 50 euros for a reservation. This amount will be forfeited when your guests no-show. It is then not yet necessary to charge VAT.

My on-call worker is sick, is he/she entitled to continued payment of wages?

An on-call worker is entitled to continued payment of wages when he/she has been employed for more than 12 consecutive weeks. You then calculate the average number of days and hours of the past 12 weeks. You may withhold a waiting day.

In my dashboard I see that the purchase for the kitchen is very high. How do I see what this is due to?

To find out, you can take a number of steps:

- Count the kitchen inventory every month for the purest possible margin.

- Make a detailed price calculation of the menu to see if it works out well. Then calculate 5% loss.

- Use a gram scale in the kitchen. This way the cooks can weigh in between and get quicker insight into the quantities when making up the plates.

- Check the invoices from suppliers to see if the agreements made are being kept and are being charged correctly. Also check whether packaging sizes have not been adjusted in the meantime.

Resources

How to deal with tips?

In the Netherlands, a guest gives on average about 5 to 10 percent tip after a visit to the hospitality industry. But how should you as an employer deal with this now?

The way we give tips has changed drastically in recent years. No more fumbling with your mobile or smartwatch, contactless with your debit card. Thanks to digitalization we have less and less cash in our pockets. The biggest reason why we have increasingly started to tip in recent years and no longer leave it as thanks on the table. The following applies when dealing with tips: When an employer does not interfere in the distribution of tips, he is also not withholding liable. The tip then does not have to be declared for withholding wage tax. The responsibility then lies with the employee to declare this correctly. Only when tips are paid by card and thus come into the employer’s account, it remains important not to interfere with the distribution. This means:

- Don’t determine the way of distribution and don’t give ideas for this either. Let employees arrange this among themselves. An example to avoid is determining whether or not the kitchen participates in the tip distribution.

- Don’t distribute the actual tip weekly or monthly yourself.

- Let employees decide for themselves how the tip is distributed and who takes on the distribution.

Am I allowed to provide staff with free food?

It seems so normal, but as a rule it is not allowed to just provide meals to your employees. If you do, you can do two things:

Addition

An addition means that the meal is seen as extra gross salary, but then paid out in kind. The employee notices this from the extra wage tax that is withheld on the salary.

Net deduction

The other option is a net deduction. You must then withhold a fixed amount per meal from the employee’s net salary. These amounts are determined annually by the tax authorities.

The first arrangement is most favorable for the employee, the second for the employer.

But there are also exceptions. When an employee is fully at work between 17:00 and 20:00 and is therefore not able to prepare an evening meal himself, then that meal may be provided without a deduction or addition. Something that naturally occurs often in the hospitality industry.